Nigel Perkins, Head of Haven Mortgages, shares his commentary on the Reserve Bank NZ (RBNZ), the Bank’s OCR projections and some key considerations for borrowers.*

RBNZ Commentary

The RBNZ has softened some of its lending ‘speed-limits’ on owner-occupied properties and investment properties. Although these changes aren’t expected to have any material impact on the property or lending market, they signal a softening stance from the RBNZ.

Last month the Reserve Bank announced a further increase in the Official Cash Rate (OCR) to 5.50%. The messaging supporting the increase signalled the top of the interest rate market. Meaning we’re now in ‘hold’ mode, as the RBNZ Governor waits to see whether the economy and inflation pressure responds to the interest rate pressure.

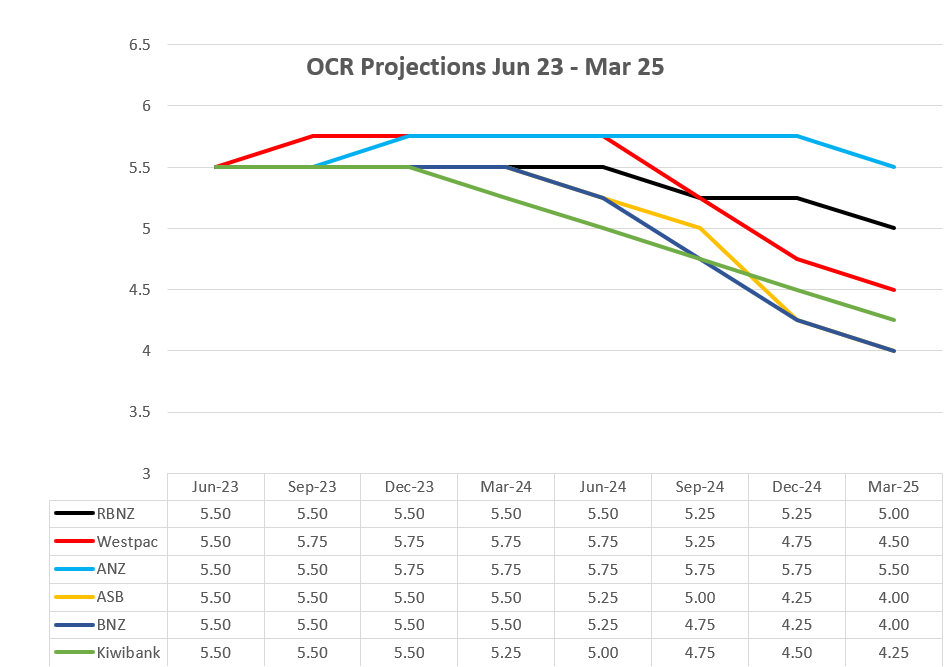

OCR Projections: Overall Banking Lens

Source: Each bank’s website or economic commentary, as at 16/6/23 – some ‘averaging’ may apply if an individual projected quarter was unavailable.

This graph highlights just how variably each bank is projecting progress over the next 2 years, with some quite differing views on the 2 year end position projection, as well as the pathway to get there.

Despite RBNZ’s comments, Westpac are calling for one further OCR hike prior to the election, and ANZ soon-after. Kiwibank, ASB & BNZ are concurring with RBNZ, and are calling the OCR has now peaked, with Kiwibank anticipating the start of the OCR reduction cycle kicking in as early as February ’24.

So, if each of the Bank’s Economics specialists can’t agree on what the future looks like, who do we believe and how do we make a decision on our mortgage? With most of us now facing an inevitable increase in mortgage rates when refixing, what do we do?

ANZ and Westpac’s Economics teams are generally indicating the most overall cost effective refix option is the currently cheaper 3 year fixed option. But there are challenges when locking in for a 3 year term. Although it can mean ‘set and forget’, that strategy has risk, especially if you end up being ‘caught high’ and rates lowering significantly.

Worse, if your circumstances change in say 18 months, and you need to sell – should the market have tracked in line with Kiwibank’s expectations, the OCR and 3 year wholesale rates would have plummeted to or below 4.00%. In light of this, you could then be facing into significant fixed rate break costs.

If the market forces were to dictate the OCR was to start its fall in February ’24, you could assume the 1 year fixed rate was likely also heading south too. On this basis, there could be equally reasonable merit in fixing in for 1 or 2 years now.

Quick Calculation

To attempt to calculate whether 1 year is better than 2 (in terms of overall, likely costs), you’ll need a few data points and some assumptions. Let’s have a try….

Yesterday (3/7/23) we received some pricing for a $500K refix loan, as follows:

6.79 – 6.42 = 0.37 differential

For the 1 year rate to be overall more cost effective than the two year rate, the 1 year rate would have to be at least twice the differential rate, in 12 months’ time (being 6.79% – 0.74% = 6.05%).

The question is, do the Banks expect the 1 year rates to be more, or less than 6.05% in 1 year from now? Because the 1 year fixed rates do tend to track in parallel with the OCR movements, you would effectively need the OCR to be approx. 75 bpts lower than today.

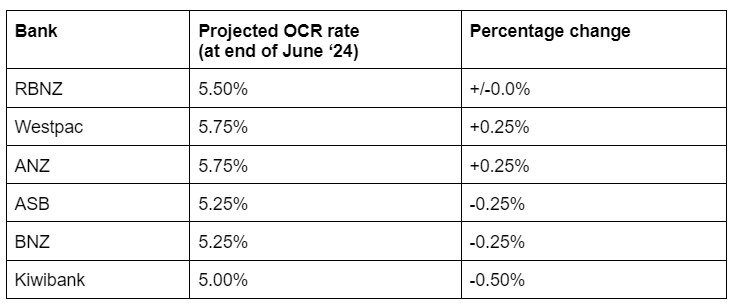

Let’s re-check in with their projections, specifically, at the end of June 24:

On these projections, no-one is picking the OCR to have reduced by 0.75% by this time next year. If this proves to be the case, in this scenario, the two year rate offered at 6.42%, appears to be the stronger option.

Do remember, interest rate markets are volatile, and despite all the data available for analysis, no-one gets these projections bang on, consistently. They are merely financial markers, to help inform your overall thinking and decision making.

What should you consider when refixing?

When making fixed rate refix decisions, there are a multitude of factors to consider including (but not limited to):

On the surface, picking a rate and locking it in can be a straightforward administrative exercise. But, picking the right rate and having your loan structure fine tuned to you, your strategies, and your budget… do yourself a service, and roll in the experts at Haven Mortgages. Best of all – they’re free!

*This article does not intend to constitute financial advice and does not take your individual circumstances and financial situation into account.

Fill out your details below and someone from our friendly team will be in touch soon.

"*" indicates required fields