Nigel Perkins, Head of Mortgages at Haven shares his commentary on the situation and how our advisers can assist you to get in front of it all.

What’s behind the continued Official Cash Rate increase?

Before yesterday’s OCR announcement, the general market sentiment was softening. Market swap rates (used as the yardstick for banks’ 1-5 years fixed rate pricing), were starting to head south, with some market commentary predicting some fixed interest rates had already peaked, even with future OCR increases already priced in.

General sentiment was one or maybe two more OCR increases of 0.25% were likely.

Instead, going against market sentiment, the Reserve Bank announced an increase of 0.5%. Pushing the OCR rate way beyond where the market had expected and reinforcing that inflation and the labour market are out of control. Although in retrospect, the Reserve Bank probably didn’t have much choice.

As an everyday Kiwi, if you hear that interest rates have peaked, you’re more likely to have confidence in your own spending, and you only have to weather a few more dark clouds before the sun is shining again.

‘Confidence’ is the fuel that fires inflation.

Make no mistake, the 0.5% OCR increase announced yesterday, has shut down any such confidence. And, is yet another blow to homeowners and business folk alike.

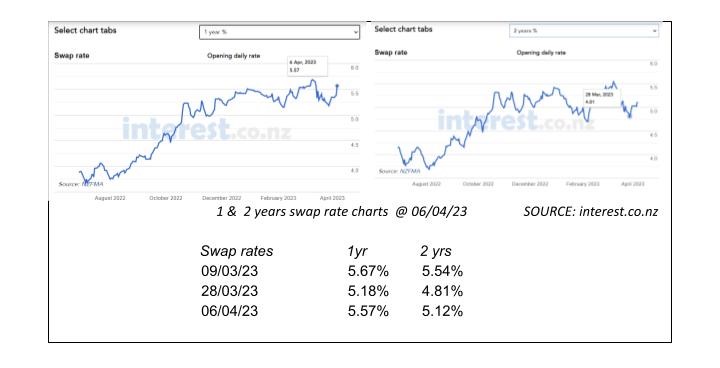

As the chart below suggests, the impact upon wholesale swap rates is immediate and the trends are the primary drivers of the banking sector’s fixed rate pricing strategy.

Short term rates will likely rise soon i.e., variable rates, through 1 year fixed rates. Interest rate increases sucks a lot of money out of the economy but ultimately, this is what the Reserve Bank needs to truly curb inflation.

If there were only hints of a recession previously, it is now a given. The fall from here will no doubt be hard. Household budgets will be stretched to capacity this year and some, beyond that. This is a cashflow crisis!

What can borrowers do to get in front of it all?

Right now, enquiries from clients are off the chart as people try to understand what sort of mortgage impact pressure is coming and what can be done to navigate it!

Our team can support borrowers to be as proactive as possible, explore if any extreme intervention is needed or if a simple tweak can help you ride out the storm ahead. With a few questions, we can understand your best options and give you confidence going forward.

Options could be:

When the property market goes slow, banks pivot and considerable incentives are made available to reward homeowners that shift their mortgage across to them. These incentives are in the form of cash, and are paid instantly upon changing over. Our role is to assess whether this is suitable for you, and if so, maximise the value to you.

So to get in front of it all, make it a priority to get in touch with a Haven Mortgage Adviser today!

Fill out your details below and someone from our friendly team will be in touch soon.

"*" indicates required fields