Last month we held a webinar led by Nigel Perkins, Head of Haven Mortgages, and joined by legal guru Kelvin Mackie, from Mackie and Co Ltd. The webinar delved into invaluable strategies on navigating the rising market pressures for borrowers and emphasised the importance of proactive engagement when it comes to managing your mortgage. Read on for a summary of the discussion that took place.

The impact of Reserve Bank actions and rising interest rates

Over the past year, the Reserve Bank has responded to inflationary pressures by adjusting the Official Cash Rate (OCR) seven times, raising it from 2.0% to 5.50%. As a result, banks have increased their interest rates from record lows to record highs with best in market 1 year fixed rates surpassing 7% p.a. These changes have added to the financial challenges faced by households.

For more on what rising interest rates really mean for your mortgage repayments, including how to calculate your mortgage repayments using our online mortgage calculator, read our blog here.

Understanding the situation and the unique financial setting of each household

We are seeing more and more clients come to us to talk about their situation with their mortgage repayments, to understand what options are available to them. They want to understand what’s behind the numbers and how we can help them.

Now more than ever, every household should take the proactive stand of facing into their own financial circumstances. Regardless of the size of the mortgage, most households will need to somehow respond to the inflationary led changes and adapt accordingly. Each situation is unique, and it requires careful consideration to identify suitable options.

Exploring mortgage relief options

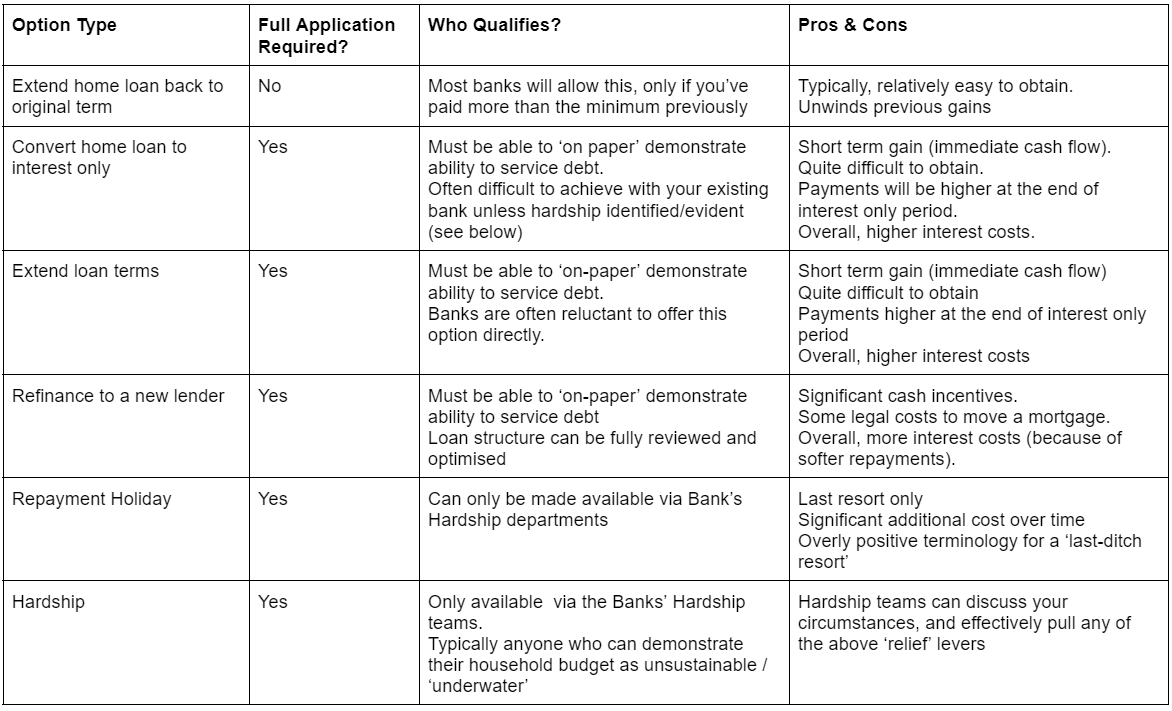

One possible response strategy, is to investigate the merits of softening the impact of interest rate changes. Some households may have the potential to consider and implement some form of mortgage relief. However, if such a plan is contemplated, it’s crucial to understand the associated qualifying thresholds, costs and implications of each option.

The following table outlines some of the possible mortgage relief options that could be made available:

Identifying available options

To identify the best available option to you, first you need to consider where you are at, including understanding your property value, your current lending settings, and your household budget. Get a good lens over what you are trying to achieve and if you’re expecting anything to change in the near future.

From there you can identify what options you may qualify for and whether they are suitable for your current situation. Consider that with a number of the above options you’ll need to show ‘on-paper’ that you can service your debt, for example with refinancing. To do this you’ll need to source a similar degree of information you supplied when you first applied for your loan and prove that you can still service the level of debt, relative to the bank’s servicing thresholds.

Remember that the majority of these ‘relief’ options come at an additional cost over the life of your loan. You should always firstly consider whether any other options are available i.e. reducing household spending elsewhere, and whether your current cash flow really warrants a relief option.

The importance of early engagement and seeking advice

A key takeaway from the webinar was the importance of engaging early to avoid a panic situation. It’s essential to face the reality of the situation as the later it is left the fewer options that will be available to you.

A great place to start is to speak with a Haven Mortgage Adviser to explore your situation and identify what options are available to you to get on top of the situation. Although a mortgage adviser cannot decide for you, they can provide you with their knowledge and education to empower you to make an informed decision.

Fill out your details below and someone from our friendly team will be in touch soon.

"*" indicates required fields