How does KiwiSaver work?

KiwiSaver is a voluntary savings scheme to help you prepare for retirement. There are a variety of funds and schemes, so it’s essential that you’re in the right one to reach your retirement goals.

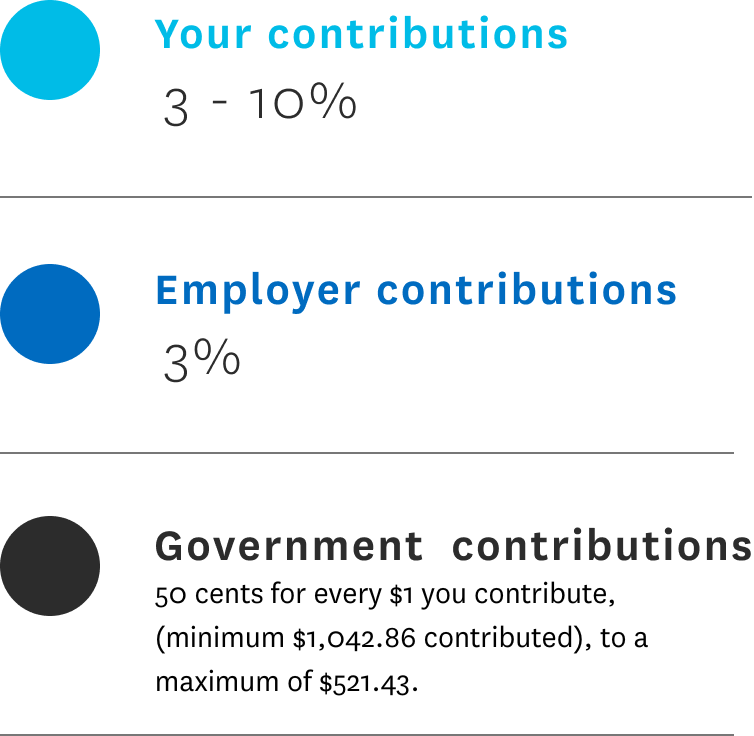

KiwiSaver is made up of:

Minus withdrawals, fees and taxes apply

Why you should use KiwiSaver

KiwiSaver isn’t compulsory, but there are a number of benefits of joining, including:

Get my KiwiSaver sorted

How much will you have at retirement?

Use our helpful KiwiSaver calculator below to find how much you could save to reach your retirement goals. Are you on track for the lifestyle you want?

How much could you save?

Assumptions

These graphs are for illustrative purposes only to help you understand how different investment choices may affect KiwiSaver savings. The figures and data may not reflect actual returns and balances. The calculator assumes a minimum starting salary of $35,000. Please note that returns may be negative for any given period and will fluctuate due to investment and other risks. This includes the risk of not getting back all of the money that you put in.

These graphs are not intended to convey personalised advice and we recommend speaking with a specialised Investment Adviser if you would like KiwiSaver advice.

The figures used in these graphs are based on assumptions consistent with those used on sorted.org.nz and are as follows:

- There is the option to have the balances adjusted to take into account inflation. This is based on a rate of 2% so that results are shown in today’s dollars.

- Employer contributions of 3% of the stated before-tax salary are taken into account after deduction of employer’s superannuation contribution tax at the current applicable rates.

- Government annual contributions are applied based on the current contribution of 50 cents for every dollar of member contributions up to a maximum of $1,042.86 per annum.

- Salaries will increase by 3.5% each year (1.5% increase plus 2% for inflation).

- You do not take any savings suspensions.

- No amounts are withdrawn for any purpose

- The after-fee returns used are based on the sorted.org.nz KiwiSaver Calculator.

- The fees used in the calculation are based on the 5 year average fee for each fund type as a percentage from sorted.org.nz.

- All calculations are based on annual member and employer contributions.

- PIR rate used assumes 2 consecutive years of the current annualised salary.

- All figures are based on a PIR rate of 28%. The assumed rate of return used for each fund type choice is outlined below. These returns are after all fees and taxes

| Fund Type | Investment Return (per annum) |

|---|---|

| Defensive | 1.5% |

| Conservative | 2.5% |

| Balanced | 3.5% |

| Growth | 4.5% |

| Aggressive | 5.5% |

To be eligible, you must be 18 years or older and and mainly live in New Zealand. If you don’t meet these requirements for the full MTC year, the maximum amount you’ll get will be based on the time you are eligible for.

Tap to read assumptions

Moving Your Super/Pension Home

You’ll need to make sure you’re eligible, and there are some restrictions. Our friendly advisers are experts at bringing pensions and superannuations back into New Zealand, so get in touch with us and we’ll get you sorted.

What our clients say

Our clients often provide us with fantastic feedback on our services. Take a look at what they have to say.

Win a trip

Haven is giving away a trip for four to the Cook Islands worth over $6,000!

Win a trip to the Cook Islands!

Simply sit down with a Haven adviser and you’ll go in the draw!* Plus, if you refer a friend, you’ll BOTH go in the draw to win a much-needed holiday.

Just some of the providers we work with on your behalf

Are you ready to get started?

Fill out your details below and someone from our friendly team will be in touch soon.

"*" indicates required fields