Whether you’re still building your deposit or feeling ready to buy, knowing the steps ahead will help you plan and prepare. You might even be closer than you think!

Are you eligible for pre-approval?

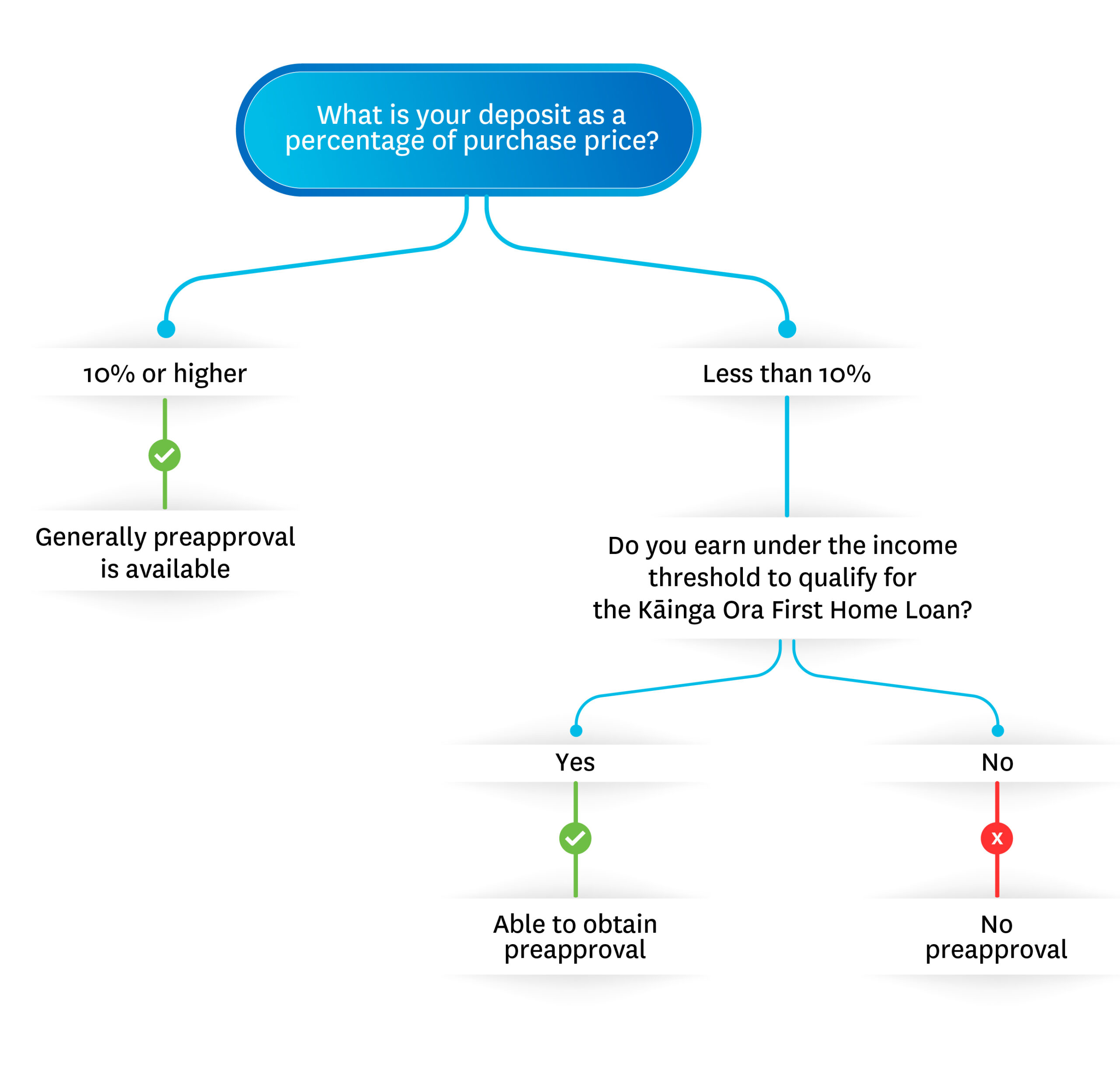

An Haven mortgage adviser can help determine whether your current situation meets the criteria for pre-approval. Use the flowchart below as a general guide to assess your eligibility:

You can see the eligibility requirements for the Kāinga Ora First Home Loan here.

If your settings allow you to secure a pre-approval, this makes you more competitive in the property negotiation process. If your settings do not allow you to secure a pre-approval, your Haven mortgage adviser will work with you to navigate the property purchase process, which will likely include a conditional offer.

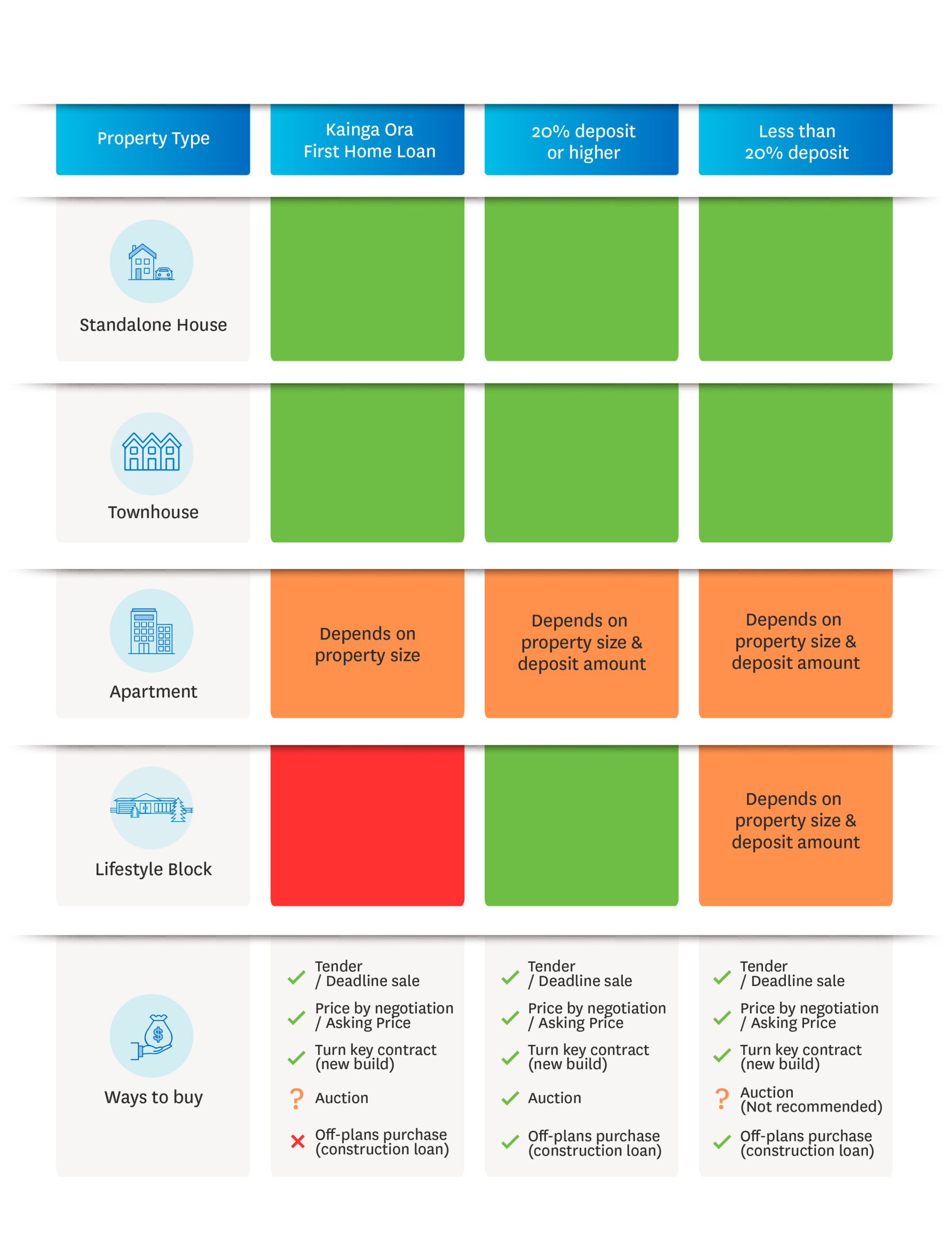

Your settings may also impact the types of properties and purchasing options available. The traffic light guide below outlines the options available, based on your deposit size:

Making an application

When you think you’re ready to submit an application, you’ll need to provide your Haven adviser with a range of documents so they can guide you through the next steps. You’ll need to provide proof of income, proof of deposit, bank statements, statement of financial position (also known as a fact find), and identification.

Once your Haven mortgage adviser has assessed your documents, they’ll let you know if you are ready to submit an application or confirm that you are ready to go house hunting!

Next steps: Initiating your mortgage application

If your Haven mortgage adviser has determined you should progress to an approval (e.g. with a live contract) or a pre-approval, here’s what to expect:

Let’s get started

When you’re ready, send an email to mortgages@haven.co.nz, and we’ll send over all the requirements to get started with your application and how best to send your documents securely.

Haven Mortgages is here to support you through each step of your journey to owning your first home. Don’t hesitate to reach out if you have questions or need assistance.

Questions or need assistance? Contact us at 0800 700 699 or complete the form below, and we’ll be happy to help.

*The information contained in this blog is for general information purposes only. It is not intended to constitute financial advice and does not take your individual circumstances and financial situation into account. We encourage you to seek assistance from a trusted financial adviser.

Fill out your details below and someone from our friendly team will be in touch soon.

"*" indicates required fields