After a long period of interest rate hikes and economic uncertainty, 2026 is shaping up to be a year of much-needed stability for mortgage holders. With the Official Cash Rate (OCR) now on pause and the major banks largely aligned in their forecasts, borrowers can begin the year with a clearer view of what’s ahead.

To help unpack the numbers and explain what this environment means for borrowers, we sat down with Nigel Perkins, Haven’s Head of Mortgages, for his take on the year ahead.

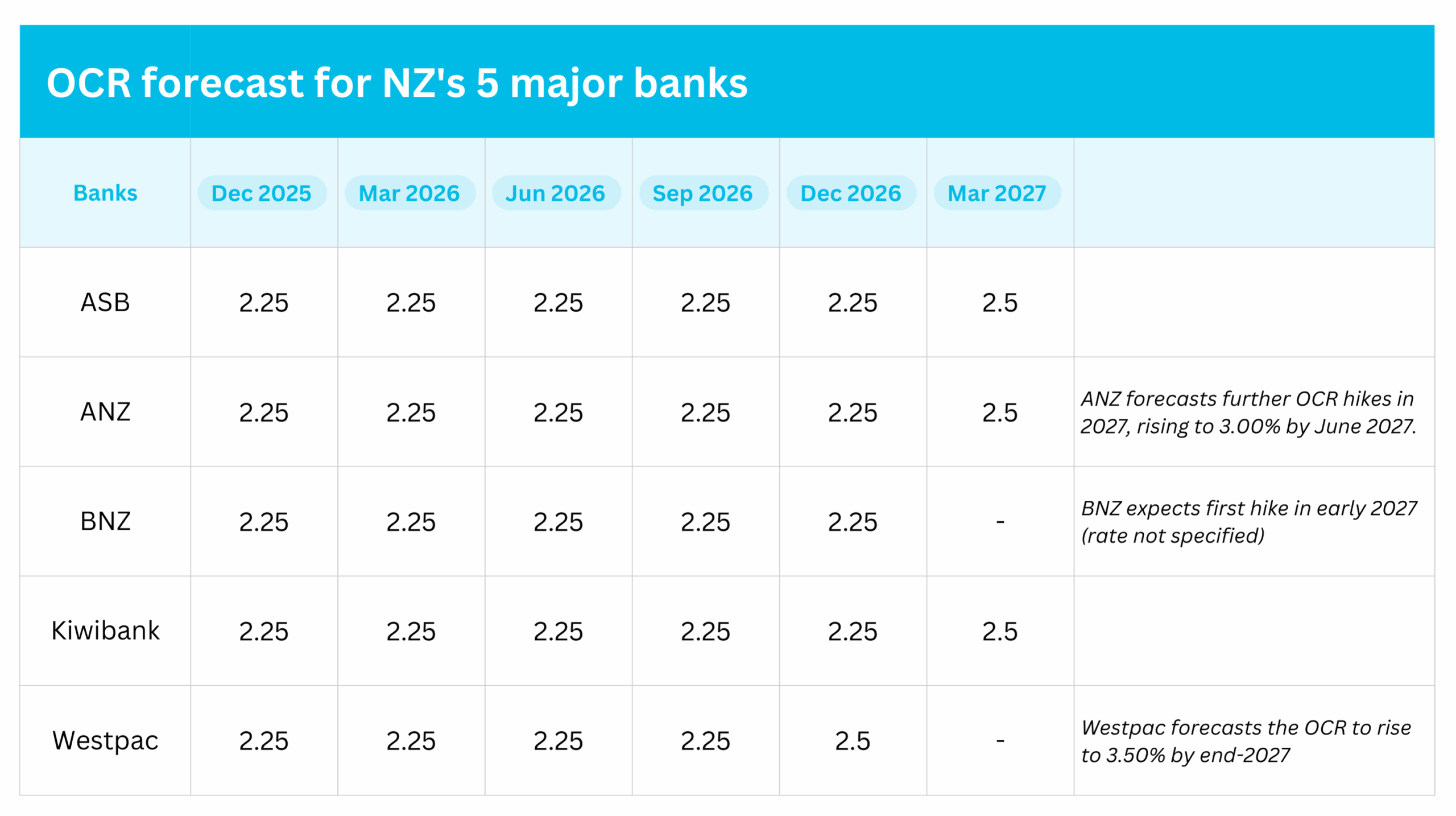

Below, we break down the forecasts from the 5 major banks, so you can see where things are headed – clearly and simply. The OCR is expected to hold steady at 2.25% throughout 2026. Some are forecasting a lift to 2.50% by early 2027, with longer-term projections hinting at possible rate increases beyond that. But for now, the message is consistent: no sharp moves on the horizon.

With rates holding steady, borrowers may enjoy a more predictable year when it comes to repayments.

Here’s what Nigel highlighted as key implications:

Stable interest rates don’t necessarily mean a booming property market. Most forecasts point to modest house price growth in 2026, rather than a rapid rebound. This reflects a market that’s finding balance again – where prices are more closely aligned with incomes, supply remains relatively healthy, and demand is steady rather than overheated.

It’s also worth remembering that 2026 is an election year – and election years often bring a degree of hesitation to the housing market. Political uncertainty can cause both buyers and sellers to pause, particularly in the second half of the year.

For current borrowers:

Floating and short-term fixed rates are likely to stay favourable. With rate stability, budgeting becomes easier.

For future borrowers:

This could be a good year to lock in a fixed rate – or consider laddering terms to balance certainty and flexibility.

For investors and movers:

The calm rate environment may support buyer confidence, but keep an eye on sentiment shifts heading into the election and beyond.

All signs point to 2026 being a year of less movement, more clarity and opportunities to plan ahead with more certainty. While modest house price growth and political factors may keep things measured, that stability could be a real advantage for those looking to refinance, buy or invest.

Chat to your Haven mortgage adviser today! Email us at mortgages@haven.co.nz or call us at 0800 700 699.

Fill out your details below and someone from our friendly team will be in touch soon.

"*" indicates required fields